Traditional telecommunications business enterprise values and their related intangible assets are in the midst of a major upheaval with rapidly changing technologies, customer preferences and proposed regulations.

Giants of the internet age - Google, Apple, Netflix, and Amazon, are invading the space at a pace the world has not seen before. Recent mergers and proposed mergers have brought industry terms such as Net Neutrality to the front pages. These changes have impacted both business enterprise values and their associated intangible assets in the industry.

Telecom Technology/Patents

The rise of various technologies and their related patents is being played out across the front pages across the country. Patents were created as an incentive for innovation, giving inventors a temporary right to commercialize their ideas, without others copying them. Accordingly, incumbents have used patents as barriers to entry. Unlike patents say for new drug formulas, patents on mobile technology often effectively grant ownership concepts, rather than tangible creations.

Nowadays, innovations in IT usually rely on many small improvements involving numerous technologies. This creates and incentive for firms to build up their patent portfolios to strengthen their position in negotiations, leading to what some describe as an arms race. As the web gravitates to mobile and patent litigation rises, patent portfolios will only increase in value. New players in the mobile device industry (Google, Apple, etc.) have disrupted the market. The recent patent deals are being led largely be legal considerations around asserting patent claims or defending against claims rather than economic ones. There are older companies that have a lot of patents but are not performing as well. The divide between a company’s perceived health and the potential value of its patents, is creating significant opportunity for patent-hungry companies.

With lawsuits becoming more popular, the big companies have paid more attention to their intellectual property and spent more money on buying patents to defend their portfolios. For example, a few years ago Google paid over $12 billion for Motorola Mobility primarily for access to 17,000 patents. The deal seemed to have been priced on a cost-per patent basis. Around the same time, Apple and Microsoft teamed up to buy 6,000 patents held by Nortel Networks for roughly $750,000 a patent or nearly four times the average price for computer, software and telecommunications patents over the last few years.

Companies are amassing patents because the mobile phone has provided a new platform of computing that firms want to dominate.

Cable Business and Franchise Rights Intangible Assets

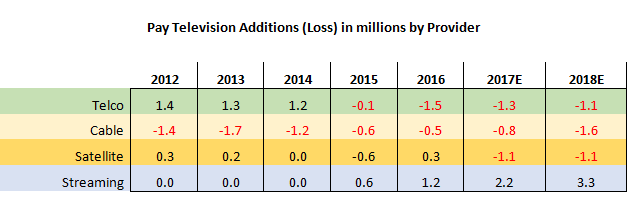

These recent developments have turned traditional US Cable businesses’ focus towards broadband services rather than television programming. In fact, CableTV subscriptions are going down while their Internet subscriptions are going up. Thus, the Cable industry which has recently been terrorized by ‘cord cutting’ is now a powerful internet utility as cable customers increasingly prize broadband Internet as the most important information pipeline coming into their home.

The Cable Market had many changes at the turn of the Century that started to question the relatively high values assigned to their indefinite-lived intangible asset Cable Franchise Rights. The Telecommunications Act of 1996 allowed any communications business to compete with each other. Thus telecommunications carriers such as AT&T, Verizon could now to provide cable television. As a result, some valuation firms were coming to the view that cable franchises were no longer exclusive legal arrangements because telecom companies were now permitted to enter cable space and did so via a combination of copper, coax and fiber infrastructure.

In addition to the Telecommunications Act, new competition also arose from direct broadcast satellite companies like Dish Network and DirecTV.

Changing customer preferences

The ‘Unbundling Pressure” movement is threatening the historical values assigned to Cable Franchise Rights.

Today, cable bundling is under assault as many consumers are expressing that they don’t want to feel forced to buy more than they want, and cable television can be seen as charging eye-popping bills for hundreds of channels that we couldn’t possibly watch even if we wanted to.

Many families are coming to the conclusion that they do not watch enough shows on cable to justify the expense as many consumers are trying to figure out what costs can be trimmed. With the growth of streaming video and its pay-per-show approach, the idea of paying $50 to $150 a month for 1,000 plus channels via a neighbourhood cable provider is no longer a slam dunk.

Consumers are starting to indicate they do not want to be force-fed anymore. The consumer is deciding that they want to be able to buy what meets their needs, and once consumers decide, change can come very rapidly.

Wireless Business and Spectrum Intangible Assets

The wireless side of telecommunications has many of the same issues as the wired side of the world. These wireless telephone companies have stayed with the wireless side of high-speed Internet access and have not jumped into the wired territory of internet access- leaving that to those of the cable companies. In fact, both Verizon and AT&T have no plans to invest in fiber beyond their current commitments. Cellular technology has been transformed from an initial analog system installed in 1984 to the new, high capacity digital networks used today. For mobile services to have the capacity to carry this additional traffic, invisible electric energy (Spectrum) is used to transmit signals and is divided into and allocated by frequencies.

Beginning in 1994, the US Government authorized the Federal Communications Commission (FCC) to auction various Spectrum bands. Spectrum works like stations on the radio dial. Licenses give companies the right to transmit at certain frequencies. The amount of information that can be conveyed goes up with the higher frequencies. With more providers in the wireless industry, spectrum auctions have become quite competitive. The United States made the transition from analog to digital broadcast television signals in 2009 which made the valuable 700 Megahertz (“MHz”) spectrum available. The FCC auctioned a 700 MHz block to a variety of carriers for higher-capacity, higher data rate services for record prices in 2015.

Valuation of Spectrum rights

Accordingly, the valuation of the indefinite-lived Spectrum asset has soared. Traditionally, the Greenfield method under the Income Approach was used to estimate the value of the FCC Spectrum asset. Here the Greenfield method estimates cash flows for a start-up company and brings them up to a normalized level. Future cash flow is converted to a present value equivalent using an estimated discount rate based on the type of cash flows being discounted. Under the Greenfield method, the assumptions typically include a company’s covered population and penetration in the defined territory, annual population statistics, the industry market size and the company’s market share, and average revenue associated with individual product line per subscriber.

Another commonly-used methodology includes the Auction Methodology which uses information on similar FCC Licensed Spectrum and population statistics sourced from the U.S. Census Bureau. Information on the Spectrum Band, FCC Defined Territory and the Spectrum Quantity are collected. Population statistics are observed in the defined territory in order to determine owned MHz Populations and dollar amount per MHz Populations.

Demand for spectrum is soaring as Americans spend more time watching video, playing games and shopping on their mobile phones. Thus the commonly used Greenfield and Auction methodologies may be undervaluing the asset from a fair value or a hypothetical market participant’s viewpoint (as defined in ASC 350, 805 and 820). In many cases, the Spectrum value could be a significant portion of a wireless company’s business enterprise value.

So what is next?

It is clear that IP assets are critical to the value of telecoms businesses, whether it is around patents (technology), broadcasting rights or Spectrum to provide mobile services. Recent developments point to an increasing rate of change in the markets, driven by technological changes and disruptive new players. In response to this we also have rapidly changing customer preferences. Any valuation of IP in a telecoms business will therefore need to take account of both the opportunities for (new) businesses as well as be cognizant of the risks inherent in quickly changing markets and customer preferences.

BDO has recently published our global Telecommunications Risk Survey 2017, which analyses the effects of recent economic, technological and political changes on the industry.